japan corporate tax rate history

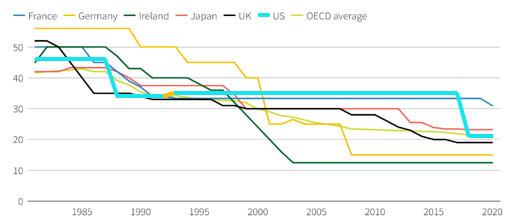

Corporate tax rates generally are the same for differing types of income yet the US graduated its tax rate system where corporations with lower levels of income pay a lower rate of tax with rates varying from 15 on the first 50000 of income to 35. Since January 1 2018 the nominal federal corporate tax rate in the United States of America is a flat 21 due to the passage of the Tax Cuts and Jobs Act of 2017State and local taxes and rules vary by.

Real Estate Related Taxes And Fees In Japan

The Corporate Tax Rate in Canada stands at 2650 percent.

. Korea ties with world in crisis. The US federal corporate income tax was first implemented in 1909 when the uniform rate was 1 for all business income above 5000. Corporate Tax Rate in Canada averaged 3757 percent from 1981 until 2020 reaching an all time high of 5090 percent in 1981 and a record low of 2610 percent in 2012.

Since then the rate peaked at 528 in 1969. The Troubled Asset Relief Program TARP is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector that was passed by Congress and signed into law by President George BushIt was a component of the governments measures in 2009 to address the subprime mortgage crisis. This page provides - Canada Corporate Tax Rate - actual values historical data forecast chart statistics economic calendar and news.

Japan objects to Russias tax plan for companies on disputed isles. Corporate tax is imposed in the United States at the federal most state and some local levels on the income of entities treated for tax purposes as corporations. Kishida keen for close S.

1 2018 the corporate tax rate was changed from a tiered structure that staggered corporate tax rates based on company income to a flat rate of 21 for all companies.

What Would The Tax Rate Be Under A Vat Tax Policy Center

Real Estate Related Taxes And Fees In Japan

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

Corporate Tax Reform In The Wake Of The Pandemic Itep

Real Estate Related Taxes And Fees In Japan

Corporate Tax Reform In The Wake Of The Pandemic Itep

How Do Taxes Affect Income Inequality Tax Policy Center

The History Of Taxes Here S How High Today S Rates Really Are

Corporate Tax Definition And Meaning Market Business News

Personal Income Tax An Overview Sciencedirect Topics

11 Charts On Taxing The Wealthy And Corporations Institute For Policy Studies

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Real Estate Related Taxes And Fees In Japan

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

Corporate Tax Definition And Meaning Market Business News

Lithuania Corporate Tax Rate 2021 Data 2022 Forecast 2006 2020 Historical